The Govt of India rolled out new tax regulations for virtual digital assets (VDAs) applicable from 1st July 2022. Under the new regulations, TDS will be applicable to Crypto/Virtual Digital Assets (VDAs) on consideration of the transfer or sale of VDAs. In this article, we have simplified the provisions mentioned in Section 194S of the Finance Bill 2022 to help you navigate through the new tax guidelines. Let us begin with understanding the concept of TDS and how it is applicable to crypto transactions.

Understanding TDS:

TDS stands for Tax Deducted at Source (TDS). It is an amount deducted when a particular transaction like salary, commission, interest, etc., is made. The individual (deductor) making the payment deducts tax at the source and transfers the same amount to the account of the Central Government. Whereas the person who receives the payment (deductee) is allowed to get the credit of the amount deducted based on form 26AS or TDS certificate issued by the individual (deductor) who made the payment.

When is TDS applicable on crypto?

As per the new regulations and based on our current understanding, TDS will be deducted in the following cases:

- On selling crypto for INR

E.g. Selling 1 ETH with an assumption that 1 ETH = 10,000 INR

| Conversion type | 1 ETH → 10,000 INR |

| Transaction fee(0.1%) | 0.001 ETH |

| Remaining amt after fee deduction | 0.999 ETH |

| TDS (1%) | 0.00999 ETH |

| Total ETH remaining after deductions | 0.98901 |

| Final Amount received in INR | 9890.1 |

Note: The above table only illustrates the TDS working for the above-mentioned translation. Other applicable taxes including capital gains should be calculated separately, if applicable.

- On swapping one crypto with another

E.g. Buying 10,000 USDT with 1 ETH with an assumption that 1 ETH = 10,000 USDT

| Conversion type | 1ETH→ 10,000 USDT |

| Transaction fee (0.1%) | 0.001 ETH |

| ETH remaining after fee deduction | 0.999 ETH |

| TDS (1%) | 0.00999 ETH |

| Total ETH remaining after deduction | 0.98901 ETH |

| Total USDT received | 9890.1 USDT |

When is TDS NOT applicable on crypto?

Following are the cases which are exempted from the TDS deduction:

- Buying crypto with INR

- Taking crypto loan

- Investing in fixed deposit

- Repay crypto loan with the same loan token

How much TDS will be deducted?

- 1% TDS will be deducted from all applicable transactions.

- 5% TDS is applicable for users specified under section 206AB of the Income Tax Act.

How is TDS processed on Kassio?

TDS deducted on every transaction will be processed at the end of the month. Kassio will pay your TDS to the Government of India on a monthly basis, and filings will be made quarterly.

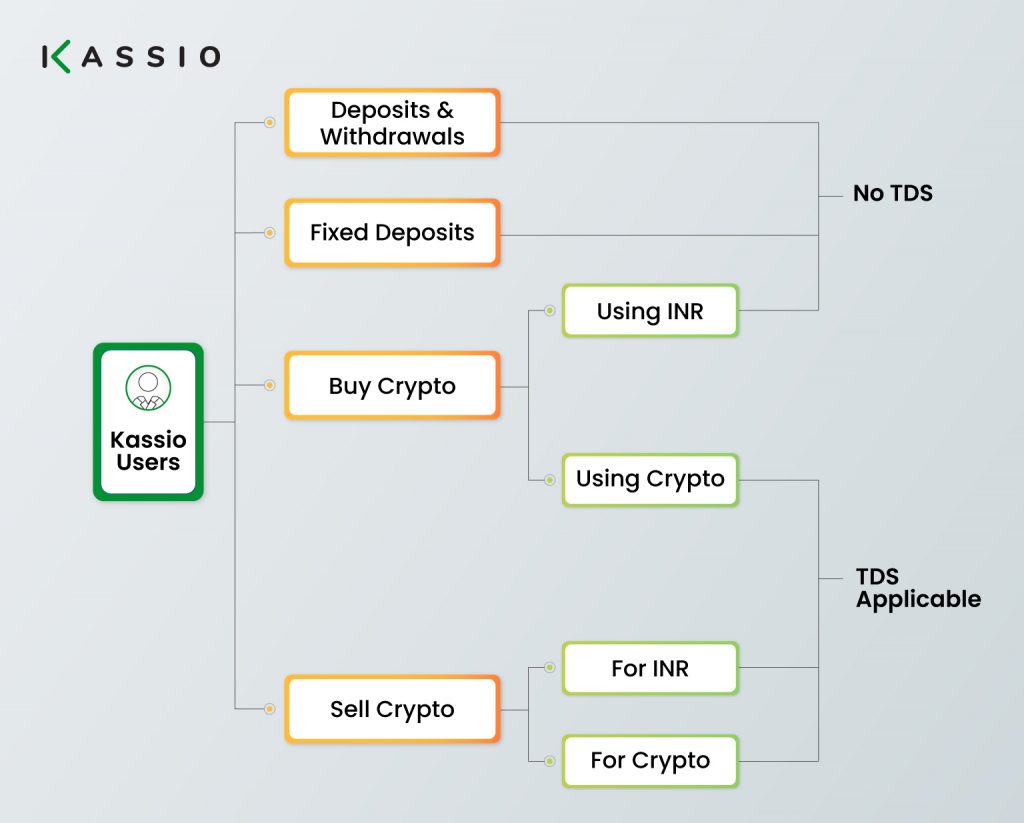

Below is the visual representation of how TDS deduction will be applicable on transactions of our platform.

We hope this article will help you to understand the new tax regulations and give you more clarity about TDS deduction on the Kassio platform. To learn more about the crypto tax regulations, you can visit the official website of Tax Authorities and refer to the Finance Bill 2022.