The rising prominence of cryptocurrency has been attracting investors globally. Since the Bitcoin (BTC) launch in 2009, the crypto world has witnessed the constant evolution of digital currencies. To improve the use cases & limitations of BTC, the idea of altcoins came into existence.

The first successful altcoin forked from BTC was Litecoin. After the formation of Litecoin in 2011, the market has observed an exponential rise in the number of altcoins. Today, there are tens of thousands of altcoins available in the market.

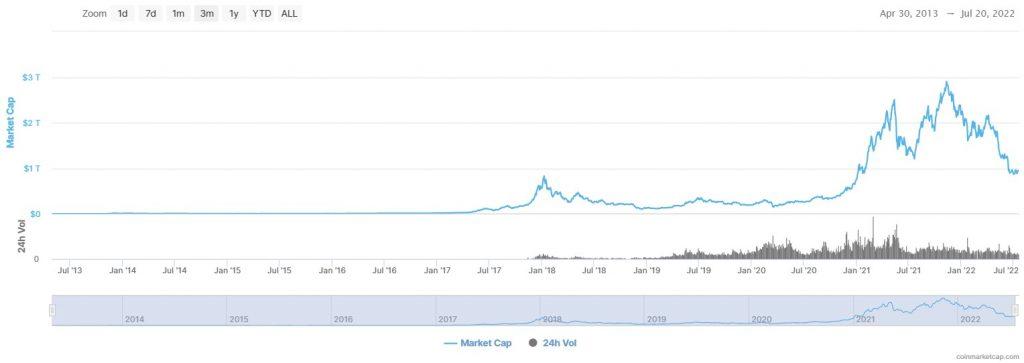

According to the data provided by Coin Market Cap, altcoin’s market capitalization (as of 20 July 2022) is around $609.62B, which captures more than 50% of the crypto market. Altcoins offer different and unique features than the popular BTC, giving investors an advantage to diversify their crypto portfolio. Some famous examples of altcoins include Litecoin, Solana, USDT, USDC, etc.

What are Altcoins?

The term “Altcoin” is an abbreviation combining two words, “Alternative” and “Coins.” Altcoins are all the cryptocurrencies present in the market, excluding Bitcoin. They operate on blockchain technology, an immutable decentralized ledger facilitating the tracking and recording of transactions in the network.

Altcoins are introduced to improve the perceived limitations of the blockchain network or cryptocurrency they are forked from. These advanced or enhanced versions of cryptocurrencies provide better transaction speed with extended utilities. For example, Solana and Ethereum can utilize smart contracts, which are essential for Defi (Decentralized Finance).

Types of Altcoins:

Based on the different utilities, altcoins are categorized into the following types:

- Stablecoins

Stablecoins are introduced to tackle the price volatility of the crypto market. Their value is pegged/ linked to a stable external reference asset like Fiat currency, commodity (Gold or Silver, Oil), or other cryptocurrencies. Stablecoins aims to bridge the gap between crypto and the real world, enabling people to get the best of both worlds. It provides all the crypto world’s benefits and stability, similar to fiat currencies.

Moreover, there are four types of stablecoins based on their value stabilizing mechanism, i.e. Fiat-collateralized, Commodity-collateralized, Crypto-collateralized, and Algorithmic Stablecoins.

- Security Tokens

Security tokens represent fractional ownership or the rights or transfer of the value of an asset, such as real estate, business or stocks etc. These are investment instruments created using the tokenization method. The information of any asset’s ownership or rights is stored on the blockchain to issue their security tokens. These tokens are offered as investment instruments to the investors. Security tokens are similar to the paper certificates issued by companies for investors who bought their stocks.

- Governance Tokens

As the name suggests, these tokens give holders the right to governance in a blockchain project. It allows holders to vote or have a say in decision-making related to the further development and modifications of the blockchain project. This method helps the Decentralized Autonomous Organizations (DAOs) to distribute the decision-making power among their communities and align themselves with token holders’ interests.

- Utility Tokens

Utility tokens are digital assets that serve as a use case in a specific ecosystem (such as games) and enable users to perform particular actions within a blockchain network, such as paying network fees, purchasing/subscribing to services, or claiming rewards.

For example, BAT (Basic Attention Token) is a native utility token of the Brave browser, a blockchain-based browser designed to be secure and private. The BAT token rewards the users for spending time on the Brave browser. Another example of a utility token is Mana; it is used to pay for goods & services in the Decentraland viz. a 3D virtual decentralized world powered by the Ethereum blockchain.

- Payment Tokens

Payment tokens include popular cryptocurrencies like Ethereum, Monero, etc. These cryptocurrencies are used as a medium of exchange, facilitating purchases, sales, and other financial transactions. These cryptocurrencies have their own blockchains. Their major function is to work as a means of payment.

The crypto market has thousands of altcoins, and all of them have diverse use cases and properties. With their emerging popularity, more investors are getting inclined toward the altcoins. If you are new to crypto, we strongly recommend you to DYOR before investing in cryptocurrencies. To learn more & understand the fundamentals of crypto, you can join our Telegram community and follow our social media handles. If you wish to explore the crypto world and its utilities, download the Kassio app now and start your crypto journey.

This is very interesting, I’ve joined your RSS feed and look forward to seeking more of your wonderful post. Also, I’ve shared your site on my social networks!

Thanks John for showing your interest:)